Detail Of Grant Of 15% Special Allowance And Revision Of Pay Scale

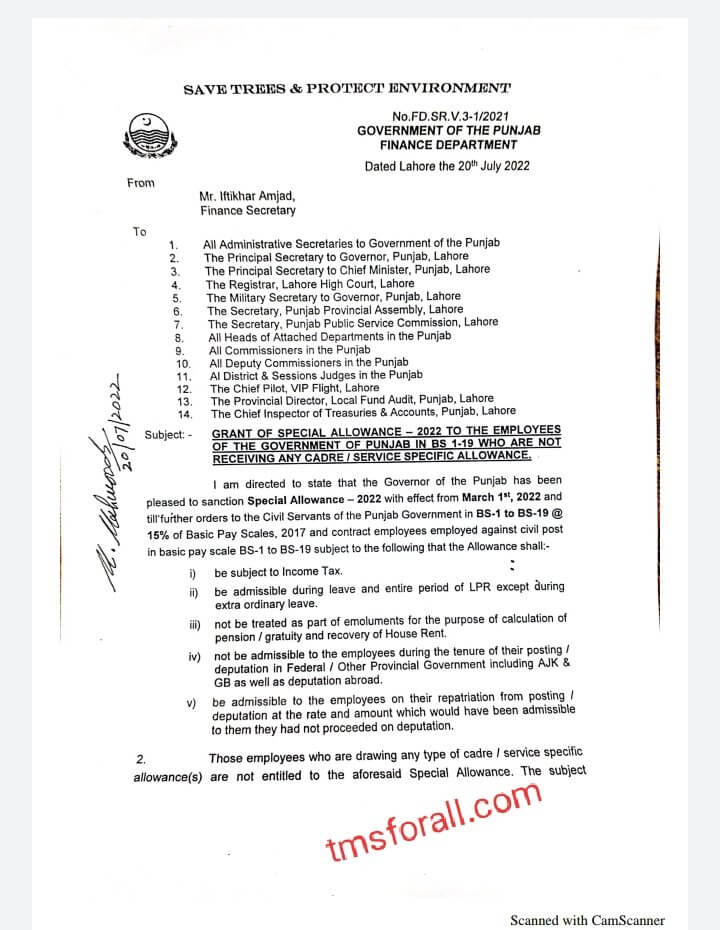

Government Of The Punjab, Finance Department finally has issued a notification dated 20th July 2022 in connection with ” Grant of Special Allowance-2022 To The Employees Of The Government Of The Punjab In BPS-1-19 Who Are Not Receiving Any Cadre/Service Specific Allowance”. The special allowance is sanctioned with effect from March 1, 2022 and till further orders to the Civil Servants of the Punjab Government in BS-1 to BS-19 @ 15% of Basic Pay Scales, 2017 and contract employees employed against civil post in basic pay scale BS-1 to BS-19 subject to the following that the Allowance shall:

- be subject to Income Tax.

- Be admissible during leave and entire period of LPR except during extraordinary leave.

- Not be treated as part of emoluments for the purpose of calculation of pension/gratuity and recovery of House Rent.

- Not be admissible to the employees during the tenure of their posting/deputation in Federal / Other Provincial Government including AJK & GB as well as deputation abroad.

- Be admissible to the employees on their repatriation from posting deputation at the rate and amount which would have been admissible to them if they had not proceeded on deputation.

Those employees who are drawing any type of cadre / service-specific allowance(s) are not entitled to the aforesaid Special Allowance. The subject allowance is only admissible to the employees who are drawing their pay in the relevant basic pay scale along with only following allowances:

- House Rent Allowance

- Conveyance Allowance

- Medical Allowance

- Adhoc Relief Allowance, 2016, 2017, 2018,2019 & 2021

The conditions mentioned in the Finance Department earlier clarifications bearing No.FD.SR-V.3-1/2021 dated 13.08.2021 and No.FD.SR-V.32/2021 dated 15.03.2022 regarding grant of Special Allowance-2021 @ 25% will also be applicable to Special Allowance-2022 @ 15% of basic pay scale 2017.

Furthermore, the subject allowance is not admissible to the employees drawing lump-sum pay packages as well as employees of Autonomous Bodies, Special Institutions and Companies.

The aforementioned allowance shall be paid in the Financial Year 2022-2023. Moreover, the concerned DDO, the Accountant General, Punjab and the concerned District Account Officer, as the case may be, shall be responsible to ensure its payment to the eligible employees only. In case of overpayment to ineligible employees, these authorities and offices shall be held personally responsible even if any such recovery is effected against such wrong payment(s).

پنجاب کے سرکاری ملازمین کو 2017 کی بیسک تنخواہ پر 15 فیصد اسپیشل الاونس دینے کا نوٹیفکیشن باضابطہ طور پر جاری کر دیا گیا *تمام سرکاری ملازمین کو مبارکباد* نوٹیفکیشن گورنمنٹ آف پنجاب فنانس ڈیپارٹمنٹ کی جانب سے جاری کیا گیا.

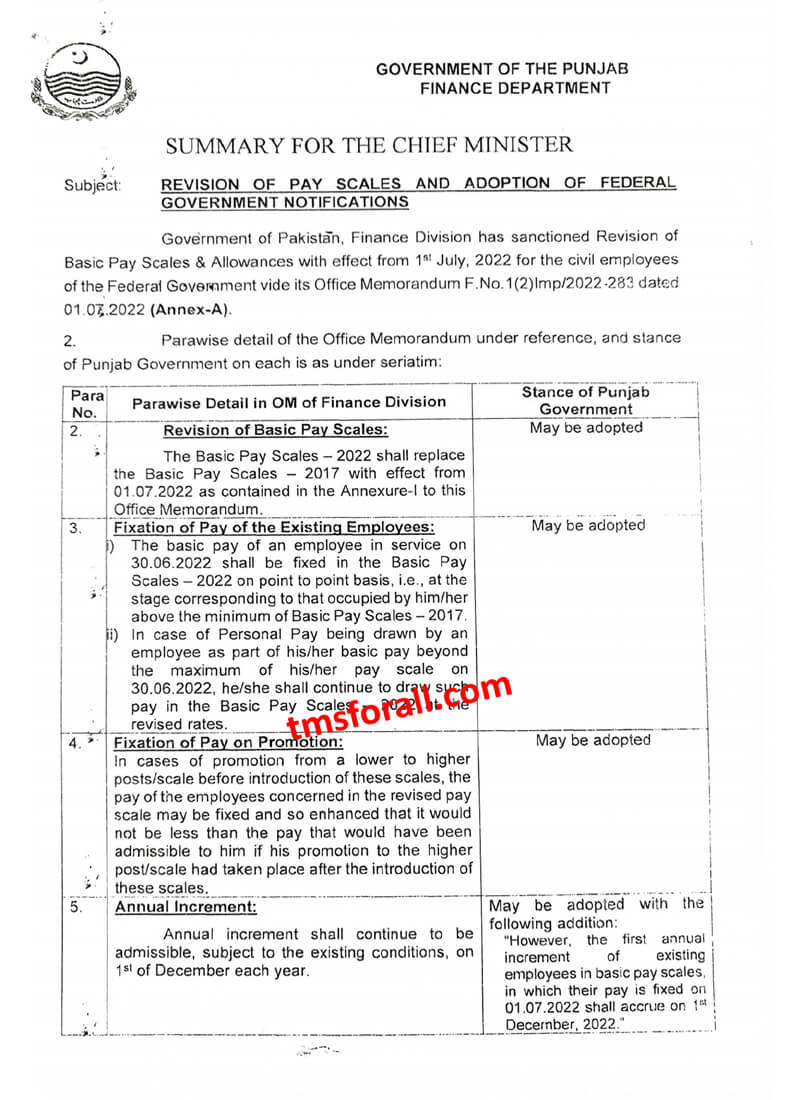

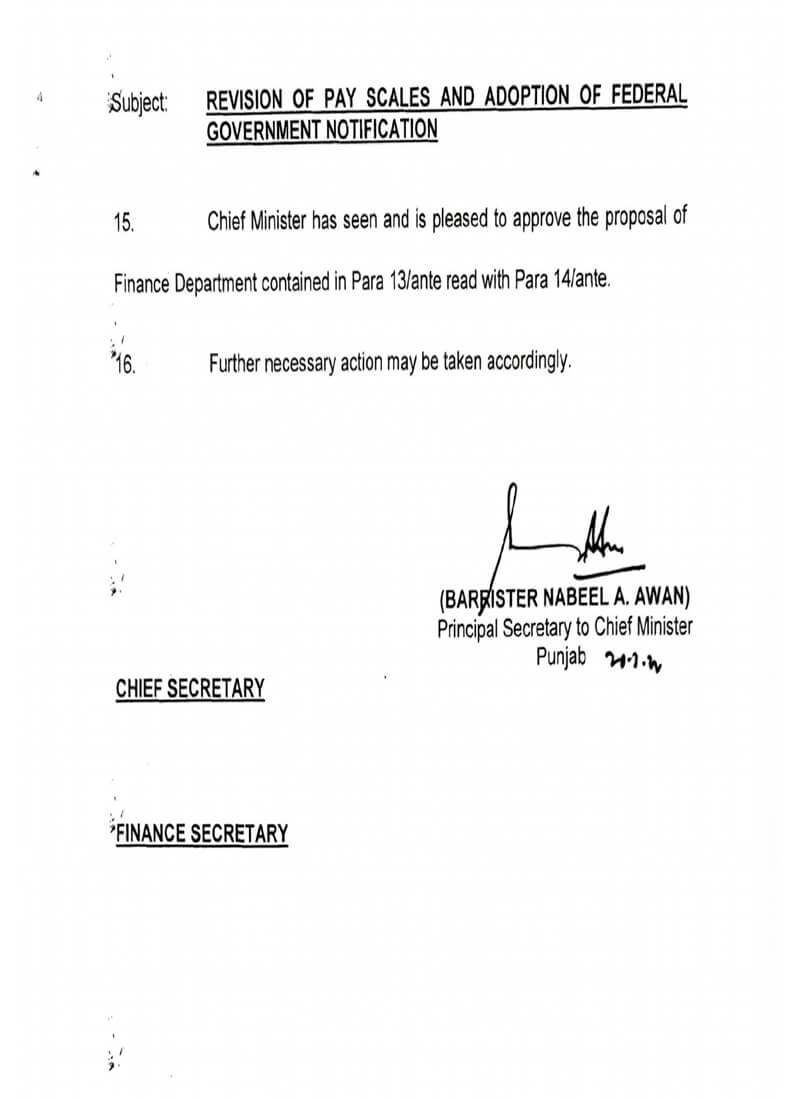

REVISION OF PAY SCALES AND ADOPTION OF FEDERAL GOVERNMENT NOTIFICATIONS

Government of Pakistan, Finance Division has sanctioned Revision of Basic Pay Scales & Allowances with effect from 1st July, 2022 for the civil employees of the Federal Government vide its Office Memorandum F.No. 1(2)Imp/2022-283 dated 01.07.2022 (Annex-A).

Parawise detail of the Office Memorandum under reference, and stance of Punjab Government on each is as under seriatim:

| Para No | Para wise Detail In OM Of Finaance Devision | Stance of Punjab Government |

|---|---|---|

| 1 | Revision Of Basic Pay Scales

The Basic Pay Scales – 2022 shall replace the Basic Pay Scales – 2017 with effect from 01.07.2022 as contained in the Annexure-l to this Office Memorandum |

May Be Adopted |

| 2 | Fixation of Pay of the Existing Employees: The basic pay of an employee in service on 30.06.2022 shall be fixed in the Basic Pay Scales – 2022 on point to point basis, i.e. at the stage corresponding to that occupied by him/her above the minimum of Basic Pay Scales – 2017. In case of Personal Pay being drawn by an employee as part of his/her basic pay beyond the maximum of his/her pay scale on 30.06.2022, he/she shall continue to draw such pay in the Basic Pay Scales – 2022 at the revised rates. | May Be Adopted |

| 3 | Fixation of Pay on Promotion: In cases of promotion from a lower to higher posts/scale before the introduction of these scales, the pay of the employees concerned in the revised pay scale may be fixed and so enhanced that it would not be less than the pay that would have been admissible to him if his promotion to the higher post/scale had taken place after the introduction of these scales. | May Be Adopted |

| 4 | Annual Increment: Annual increment shall continue to be admissible, subject to the existing conditions, on 1st of December each year. | May be adopted with the following addition:

“However, the first annual increment of existing employees in basic pay scales, in which their pay is fixed on 01.07.2022 shall accrue on 1st December, 2022.” |

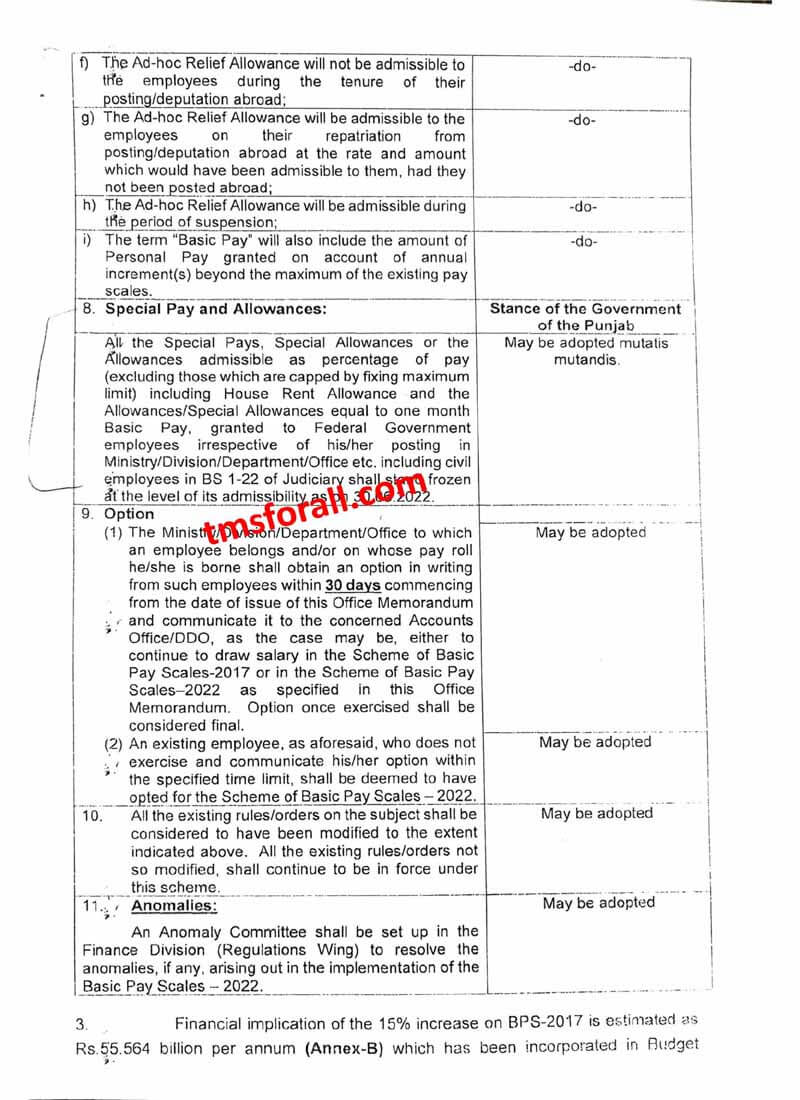

Part-ll| (Allowances)

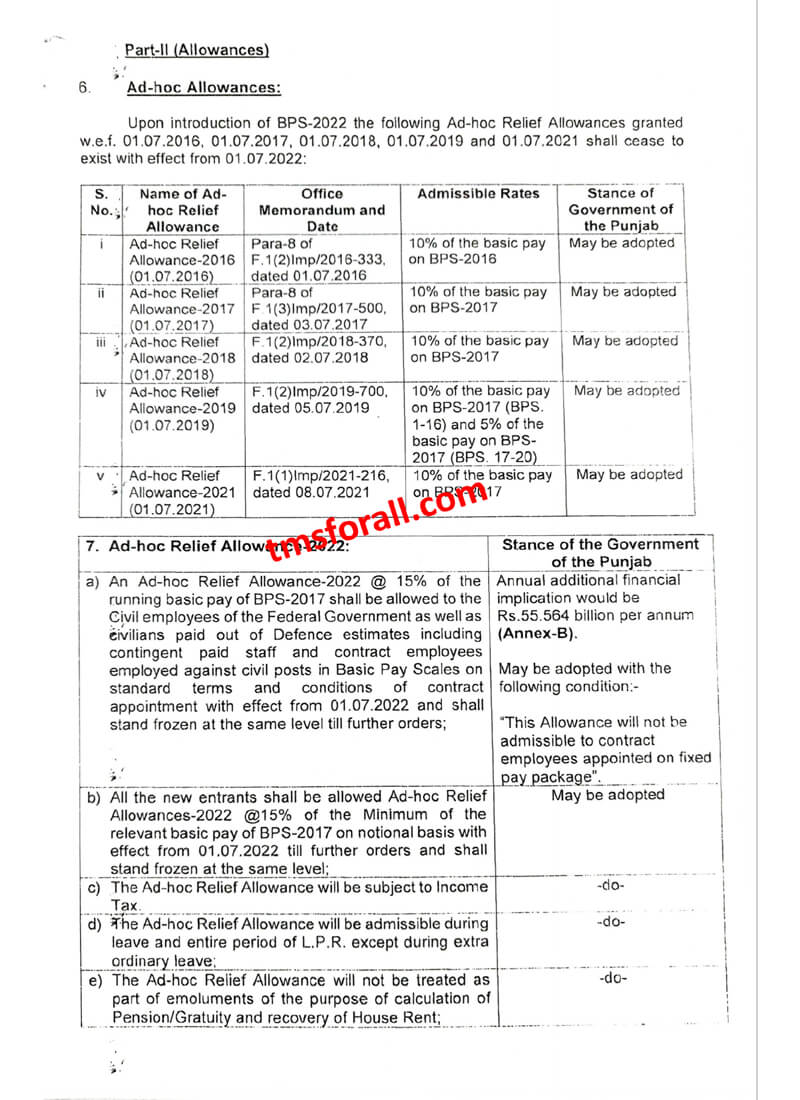

Ad–hoc Allowances:

Upon introduction of BPS–2022 the following Ad–hoc Relief Allowances granted w.e.f. 01.07.2016, 01.07.2017, 01.07.2018, 01.07.2019 and 01.07.2021 shall cease to exist with effect from 01.07.2022:

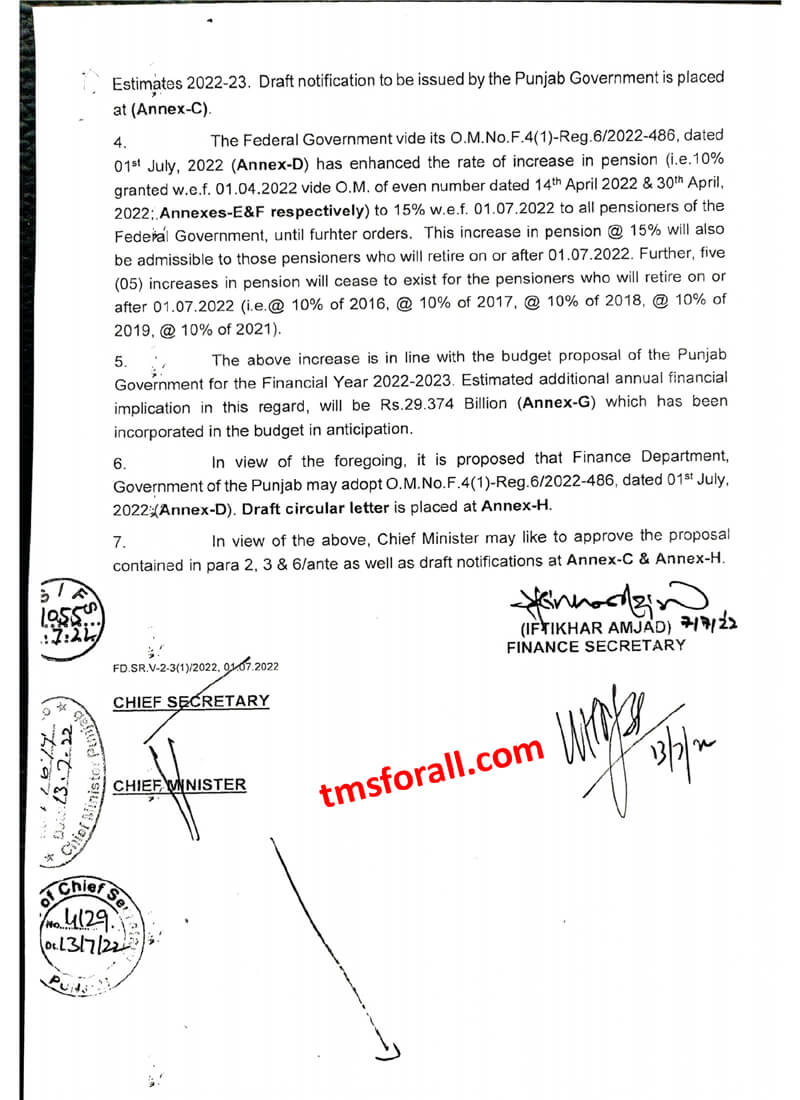

Financial implication of the 15% increase on BPS–2017 is estimated as Rs.55.564 billion per annum (Annex–B) which has been incorporated in Budget

Estimates 2022–23. Draft notification to be issued by the Punjab Government is placed at (Annex–C). 4. The Federal Government vide its O.M.No.F.4(1)–Reg.6/2022–486, dated 01st July, 2022 (Annex–D) has enhanced the rate of increase in pension (i.e. 10% granted w.e.f. 01.04.2022 vide O.M. of even number dated 14th April 2022 & 30th April, 2022;, Annexes–E&F respectively) to 15% w.e.f. 01.07.2022 to all pensioners of the Federal Government, until furhter orders. This increase in pension @ 15% will also be admissible to those pensioners who will retire on or after 01.07.2022. Further, five (05) increases in pension will cease to exist for the pensioners who will retire on or after 01.07.2022 (ie.@ 10% of 2016, @ 10% of 2017, @ 10% of 2018, @ 10% of 2019, @ 10% of 2021). 5.

The above increase is in line with the budget proposal of the Punjab Government for the Financial Year 2022–2023. Estimated additional annual financial implication in this regard, will be Rs.29.374 Billion (Annex–G) which has been incorporated in the budget in anticipation. 6. In view of the foregoing, it is proposed that Finance Department, Government of the Punjab may adopt O.M.No.F.4(1)–Reg.6/2022–486, dated 01st July, 2022:(Annex–D). Draft circular letter is placed at Annex–H. 7.

In view of the above, Chief Minister may like to approve the proposal contained in para 2, 3 & 6/ante as well as draft notifications at Annex–C & Annex–H.